Temp/contract recruitment sales soar as state economies open up

The tide turns and temp/contract recruitment sales soar as state economies open up

Australian recruitment agencies have endured much throughout the pandemic. However, the continued surge in temp/contract sales proves there's light at the end of the tunnel.

It's been a tumultuous year for recruitment agencies, to say the least. The economic impacts of COVID-19 have rippled through the industry, delivering huge blows and forcing some firms to close their doors. Having spoken to five such unfortunate owners, the overwhelming reason coming through is, "it's all too hard" and I understand what's being said, the quantum of change is a daunting challenge that not everyone has the appetite for. However, in the wake of all the doom and gloom, we can finally report some positive news based on data from 79 Australian recruitment agencies.

Since the onset of COVID-19, we have suggested the demand for flexible staffing solutions would increase. Now, as we move towards some form of COVID-normal, we see this reflected in the data. As state economies open up, temp and contract recruitment sales are on the rise. Not for all, but for quite a few and it's happening sooner than many expected. Here, we look at how the temp/contract market is surging, including comparisons by state. We also discuss trends for permanent sales and consider what the future might hold over the coming months.

Temp/contract sales surge, closing the gap on 2019

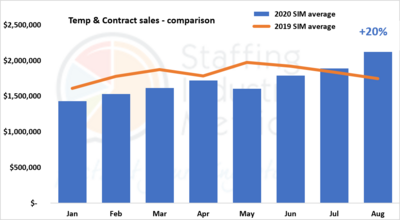

In the first half of 2020, temp/contract sales were sitting below comparative figures for 2019. However, we have seen a steady monthly improvement since February, with temp/contract sales in July nudging slightly ahead of July 2019, the first month this year to do so. August was stronger again, with results exceeding last year's figures by an impressive 20%.

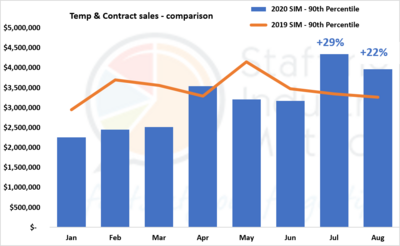

These results were consistent across recruitment firms of all sizes, including firms with $50m+ turnover. However, two sensational months in July and August sets these top performers apart from the rest. In July and August 2020, sales surpassed 2019 figures by an outstanding 29% and 22%, respectively, as shown in the chart below.

Looking at the overall picture, the view is encouraging for the temp/contract market. The collective data from 87 participants shows that Australian recruitment agencies are closing the gap on 2019, with temp/contract sales for January to August down just 6% on last year. In the context of the global pandemic, this is a good result and likely to improve as the borders, restrictions and Victoria open for business.

Temp/contract sales by state

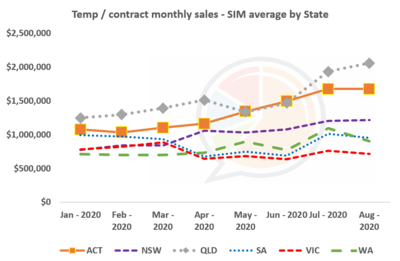

In light of ongoing border closures and workforce restrictions, the temp/contract market continues to perform as anticipated. Of course, there are vast differences between states, with Victoria suffering the biggest blow as a result of extended lockdowns. As the chart below shows, recruitment agencies across all states recorded growth since January, with the exception of Victoria and South Australia.

Taking January as a starting point for all States, Queensland firms recorded the most growth (65%), followed by NSW (57%), ACT (55%) and WA (26%). Although SA temp/contract sales declined by -4% overall since January, the data shows gradual improvement since July. In Victoria, temp/contract sales are down by -9% for the year to date. However, with many businesses preparing to reopen, we hope to see improvements sooner rather than later.

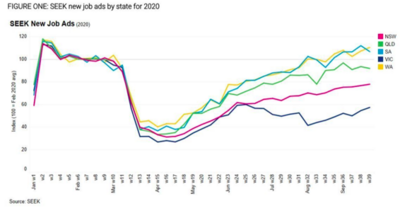

If data from SEEK is any indication, good news is on the horizon. The SEEK New Job Ads chart below shows a significant increase in job ads across all states. With Christmas and 'spending season' fast approaching, the demand for temp/contract recruitment is likely to continue.

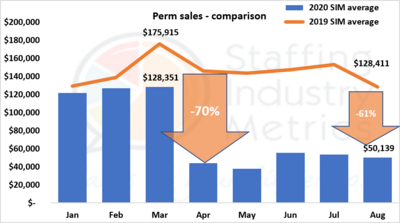

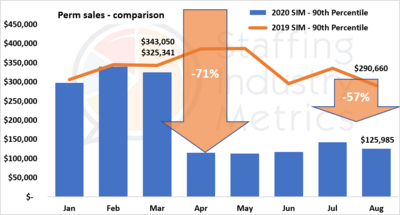

The seesaw effect for permanent sales

While temp/contract sales are soaring, the permanent market has experienced a predictable slump as a result of the pandemic. Perm sales for Q1 of 2020 were already down on the prior year before COVIC-19 struck. When work-from-home and remote working restrictions were imposed, sales took an instant 70% hit, plunging to devastating lows. Although we have seen slight monthly improvements, the market remains well down on last year with many firms reporting declines of 40% to 60% on the year to date.

This subdued trend is consistent across the board, even amongst firms in the 90th percentile with the largest slice of the permanent pie ($3m to $4m annual perm sales), as shown in the chart below.

Despite the massive drop in sales, the overall outlook is better than expected considering the market conditions. As with temp/contract sales, we can expect to see continued improvement for perm as Victoria emerges from lockdown and borders begin to open up.

Final thoughts

While COVID-19 has taken its toll, the recent surge in temp/perm sales proves there is light at the end of the tunnel. The temp/contract market is a big part of the solution to reopening the economy and creating jobs quickly, and many Australian recruitment firms are capitalising on that. Similarly, it seems that more businesses are recognising the benefits of a flexible workforce.

For now, recruitment agencies should ride the wave, but be prepared for sudden changes as government subsidies such as Jobkeeper wind up. These subsidies have kept many companies afloat during the peak of the crisis and the true extent of the damage will only be revealed once these payments cease, creating a potential tsunami of unemployment and debt with outcomes we have yet to consider. If COVID-19 has taught us anything, it's that we never quite know what's around the corner. Stay informed, stay nimble, optimistic, and importantly stay open to new possibilities.

How does your recruitment agency compare?

Find out how your business metrics stack up against current industry results with Staffing Industry Metrics' free Complimentary Benchmark Report. You'll get access to a free sample dashboard, with 12 Fast Fact Reports highlighting benchmark comparisons specific to you.

) Author:Nigel Harse FRCSA

Author:Nigel Harse FRCSA| Tags:Perm Sales in Australia, flexible staffing solutionsAustralian recruitment agenciesRecruitment Salescoronavirus impactsInsights Blog |